The Death of the IAM Monolith: Dismantling the Identity Tax in Financial Services and Healthcare

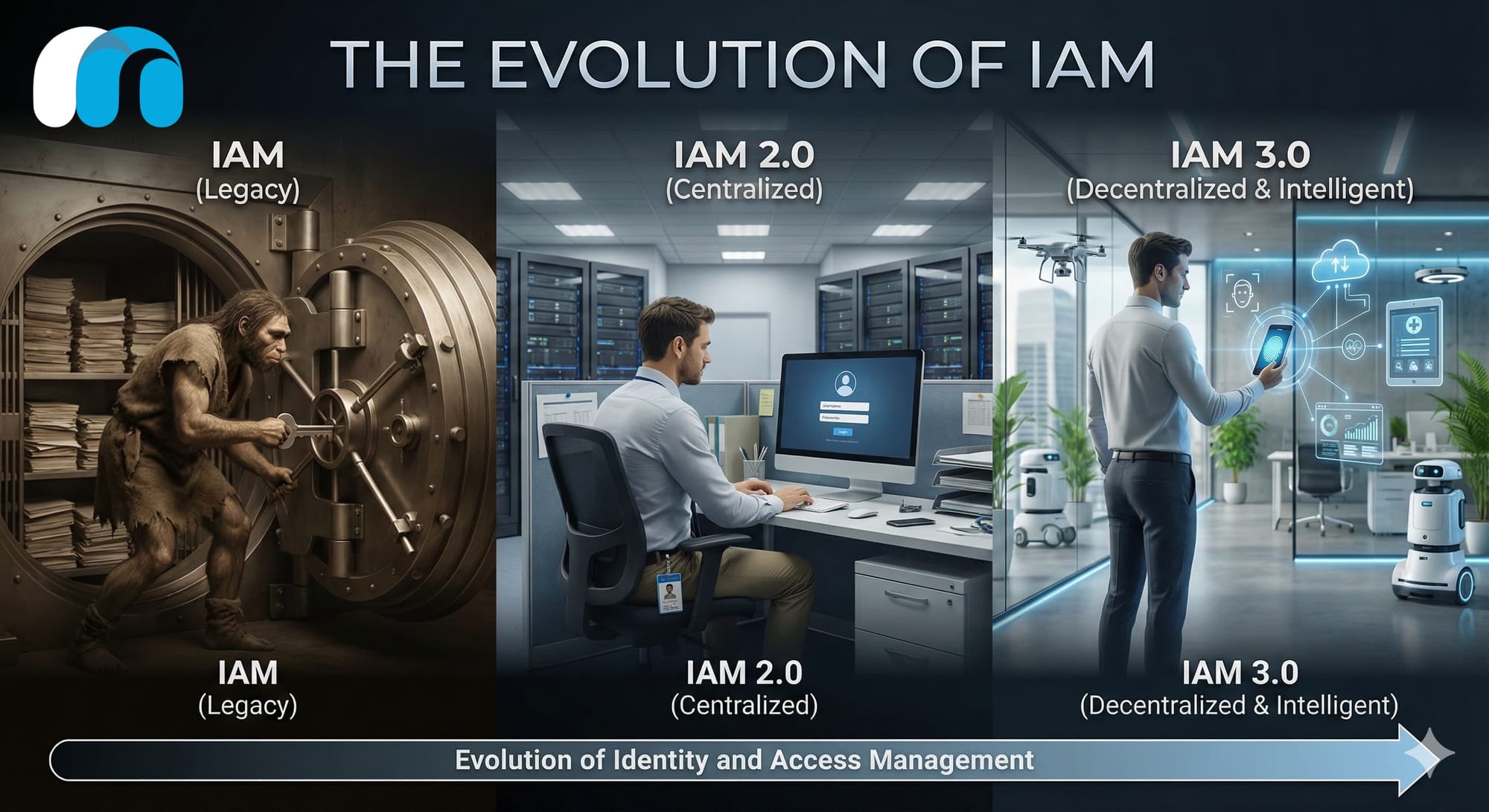

Legacy IAM 2.0 is slowing banks, insurers, and hospitals with clunky logins, high costs, and risky blind spots. The article calls for IAM 3.0: smarter, real-time identity that sees humans and machines, cuts friction, boosts security, and proves value across the business, safely.

Executive Manifesto: The Inevitability of Disruption

For leaders in Banking, Financial Services, Insurance (BFSI), and Healthcare, the digital perimeter has not just shifted, it has evaporated. For two decades, these regulated industries have poured billions into Identity and Access Management (IAM) 2.0, a model built on the fallacy that we can define a clear "inside" and "outside."1 This "monolithic" approach, characterized by rigid directories, brittle single sign-on (SSO) federations, and periodic governance reviews, has failed.

The evidence of this failure is not theoretical; it is measured in the catastrophic ransomware payments of healthcare giants, the operational paralysis of casinos, and the silent exfiltration of data from financial warehouses. We are currently paying a hidden, exorbitant levy on every transaction, claim, and patient interaction: the Identity Tax.

This tax manifests as the 70% of potential banking clients who abandon onboarding due to friction. It is the weeks lost by insurance brokers struggling to access carrier portals. It is the "clinician burnout" fueled by 45 minutes of daily login struggles. And most dangerously, it is the exposure of the "hidden org chart," the millions of unmanaged Non-Human Identities (NHIs) executing high-frequency trades and processing claims without oversight.

This report articulates the strategic pivot to IAM 3.0: an intelligent, adaptive, and decentralized framework. It is a call to move beyond "platform sprawl" and adopt a Mesh-aligned strategy: "start small, prove fast, scale by pattern." The era of the monolith is over; the age of intelligent identity has arrived.

The Anatomy of Failure: Why IAM 2.0 is Broken

IAM 2.0 was designed for a world of stationary employees and on-premise servers. In the modern regulated enterprise, it has calcified into a liability.

The Monolithic Architecture Trap

Legacy IAM platforms operate on "brittle federation." They rely on static rules and manual ticketing systems that cannot keep pace with the velocity of modern business. In banking and insurance, where mergers and acquisitions (M&A) are common, integrating these monolithic directories can take years, leaving critical gaps that attackers exploit.

These systems suffer from Data Latency. They typically "poll" for access changes daily or hourly. In a high-frequency trading environment or a 24/7 hospital, a daily sync is an eternity. Attackers leverage this gap to spin up rogue service accounts, exploit them, and vanish before the IGA tool even wakes up.

The "Identity Tax": A Sector-by-Sector Analysis

The "Identity Tax" is the aggregate cost of legacy identity friction, maintenance, and failure.

Table 1: The Identity Tax Across Industries

| Sector | The "Tax" Manifestation | Economic Impact |

|---|---|---|

| Banking & Wealth | Onboarding Abandonment: High-friction KYC/AML checks drive away digital-first customers. | 70% of potential clients abandon applications; rising customer acquisition costs. |

| Insurance | The Broker Bottleneck: Independent agents struggle with multiple carrier portals and disjointed logins. | Lost premiums to competitors with easier portals; high operational costs for help desks. |

| Healthcare | Clinician Burnout: Doctors wasting time on logins rather than care; lack of portable credentials. | Reduced patient throughput; "password fatigue" leading to unsafe workarounds. |

| Cross-Industry | Maintenance Spend: Budget consumed by patching brittle connectors instead of innovation. | 60–70% of IAM budget spent "keeping the lights on"; innovation stagnation. |

The Failure of Static Defenses: 2024-2025 Breach Anatomy

Recent breaches demonstrate that static credentials, even with standard MFA, are defenseless against modern attacks.

- Healthcare's Wake-Up Call (Change Healthcare): The devastating ransomware attack on Change Healthcare (UnitedHealth) paralyzed the US healthcare payment system. The entry point? A remote access portal lacking Multi-Factor Authentication (MFA). This was a classic IAM 2.0 failure: relying on a static password for a critical gateway in an era where identity is the only perimeter.

- The "Trusted Insider" Fallacy (MGM & Caesars): Attackers utilized "vishing" (voice phishing) to socially engineer help desks into resetting credentials. Once inside, they were treated as trusted insiders because IAM 2.0 lacks behavioral context. It couldn't see that the "employee" was accessing systems in a way no human ever would.

- The Snowflake Campaign (Finance & Tech): Attackers bypassed authentication by using "infostealer" malware to harvest session tokens from unmanaged devices. They exploited "ghost logins," local accounts that persisted outside the SSO umbrella, proving that legacy governance tools cannot secure what they cannot see.

The Rise of the Machine: The Hidden Org Chart

While regulated industries obsess over human access (KYC, workforce IAM), a far larger threat has emerged: Non-Human Identities (NHIs).

The "Hidden Workforce" in Finance and Insurance

Machine identities now outnumber human identities by a factor of 45:1 in enterprise environments. In BFSI, this "hidden workforce" is critical but ungoverned.

- High-Frequency Trading (HFT): Algorithms execute trades in microseconds. These "bots" possess high-privilege access to exchange gateways. If an HFT identity is compromised or repurposed (as seen in "agentic misalignment"), the financial fallout is instantaneous and catastrophic.

- Agentic AI in Wealth Management: Financial institutions are deploying "AI Agents" to automate portfolio management. These agents act autonomously, creating a "hidden org chart" of entities that have decision-making power but lack traditional identity governance.

- Telematics & IoMT: In Insurance, "Usage-Based Insurance" relies on telematics devices (machines) transmitting data. In Healthcare, the Internet of Medical Things (IoMT) connects infusion pumps and MRI machines. These devices often use hardcoded credentials or long-lived certificates that legacy IAM tools ignore, creating a massive, unmonitored attack surface.

The Developer Velocity Friction

Developers in Fintech and Insurtech prioritize speed. When IAM 2.0 processes slow them down, they create "Shadow IT," hardcoding API keys into source code or creating local admin accounts. This was the vector for the Shai-Hulud supply chain attack, where malware hunted for these secrets in developer environments.

Defining IAM 3.0: Intelligent, Adaptive, Decentralized

IAM 3.0 is a paradigm shift from Static Gatekeeping to Continuous Trust Mediation. It is built on the philosophy that Identity is the New Perimeter, and that perimeter must be intelligent.

Mesh's Three Pillars of IAM 3.0

To dismantle the monolith, organizations must adopt a composable architecture, exemplified by platforms like Hydden, that focuses on three distinct capabilities:

1. Universal Discovery (The "Clean Data" Layer)

You cannot govern what you cannot see.

- Capability: Continuous, AI-driven discovery of every identity; human, machine, and third-party across on-prem, cloud, and legacy mainframes.

- BFSI Application: Automatically identifying "ghost" service accounts in trading platforms and unmanaged API keys in open banking interfaces.

- Impact: Eliminates the "blind spots" that led to the Snowflake and Change Healthcare breaches.

2. Real-Time Observability (The "Nervous System")

Moving from periodic "snapshots" to streaming intelligence.

- Capability: Streaming identity events to detect anomalies as they happen. It asks: "Is this behavior normal for this identity?"8

- Insurance Application: Detecting if a claims adjuster's account is accessing sensitive policy data at 3 AM from an unusual location (indicating token theft).22

- Impact: Shifts security from reactive cleanup to proactive threat detection.8

3. Automated Control (The "Immune Response")

Intelligence must lead to action without human latency.

- Capability: Auto-remediation of over-privileged accounts and "micro-certifications" triggered by risk events rather than calendar dates.

- Healthcare Application: If a device (IoMT) behaves anomalously, its access is instantly revoked without disrupting clinical workflows for humans.

- Impact: Drastically reduces the "Maintenance Spend" of the Identity Tax.

Industry-Specific Strategy: Repealing the Tax

Banking & Wealth: The Trust Economy

The Challenge: High abandonment rates (70%) in onboarding and the risk of "Agentic AI" bypassing controls.5

The IAM 3.0 Fix:

- Reusable Identity (SSI): Enable customers to bring their own verified credentials (government ID, KYC checks) in a digital wallet. This "verify once, use everywhere" model drops onboarding time from days to seconds, directly attacking the 70% abandonment rate.

- Governing the "Hidden Org Chart": Treat AI Agents as "first-class citizens" in IAM. Assign them human owners, enforce least privilege, and rotate their credentials automatically using tools that specialize in NHI discovery.

Insurance: The Ecosystem Enabler

The Challenge: "Operational friction" with independent agents/brokers and securing the telematics data stream.7

The IAM 3.0 Fix:

- B2B IAM & Delegated Administration: Instead of managing every broker's identity centrally (the monolith), federate trust to the brokerage firms. Allow them to manage their own users within policy guardrails. This removes the carrier's IT team from the loop, reducing friction and cost.

- Telematics Identity Security: Assign unique, managed machine identities to telematics devices. Use real-time observability to ensure a compromised car sensor cannot be used to pivot into the main claims database.

Healthcare: The Care Accelerator

The Challenge: Clinician login fatigue and the massive risk of IoMT ransomware.

The IAM 3.0 Fix:

- Tap-and-Go Access: Use proximity-based authentication (Bluetooth/NFC) combined with passive behavioral biometrics. A clinician walks up to a station, it unlocks; they walk away, it locks. No typing complex passwords.

- Verifiable Credentials for Staff: Enable "roaming" nurses and locum tenens (temps) to present verifiable credentials (licenses, certifications) for instant onboarding, ensuring they can treat patients on Day 1, not Day 7.

The Strategic Roadmap: "Start Small, Prove Fast"

Do not attempt a "Big Bang" replacement of your legacy stack. That is the monolithic mindset. Instead, use the Mesh Digital methodology:

Phase 1: The Regulator-Friendly Slice (Days 0-90)

- Action: Select a critical, high-visibility scope (e.g., the SWIFT gateway in banking, or the remote access portal in healthcare).

- Deploy: Implement an IAM 3.0 overlay (like Hydden) for Universal Discovery only. Turn on the lights.

- Win: Identify and remediate "ghost admins" and unmanaged NHIs. Show the Board a 50% reduction in the attack surface without disrupting business.

Phase 2: Prove Fast & Self-Fund (Days 90-180)

- Action: Automate the most painful manual process in that slice (e.g., broker onboarding or quarterly access reviews).

- Win: Calculate the hours saved (the "Identity Tax" repeal). Use these savings to fund the next phase. "Fund IAM 3.0 through capacity prioritization and reuse."

Phase 3: Scale by Pattern (Day 180+)

- Action: Standardize the connector and policy patterns. Roll them out to other business units (Wealth, Claims, Clinical).

- Win: Institutionalize IAM 3.0 as the new operating model.

Conclusion: The Only Way Out is Through

The "Identity Tax" is not a cost of doing business; it is the price of obsolescence. In a world of AI agents, relentless ransomware, and disappearing perimeters, IAM 2.0 is no longer a shield, it is a target.

For leaders in Banking, Insurance, and Healthcare, the choice is binary: cling to the monolith and continue paying the tax in lost revenue and breach costs, or embrace the Mesh philosophy. By treating Identity as the New Perimeter and adopting an intelligent, adaptive, and decentralized approach, you can transform identity from a vulnerability into your greatest competitive advantage.

The walls are down. The keys are scattered. It is time to build a nervous system that knows who, and what, is holding them.