The 2026 Mandate for Mid-Market CDOs: Bridging the Gap Between AI Hype and Operational Reality

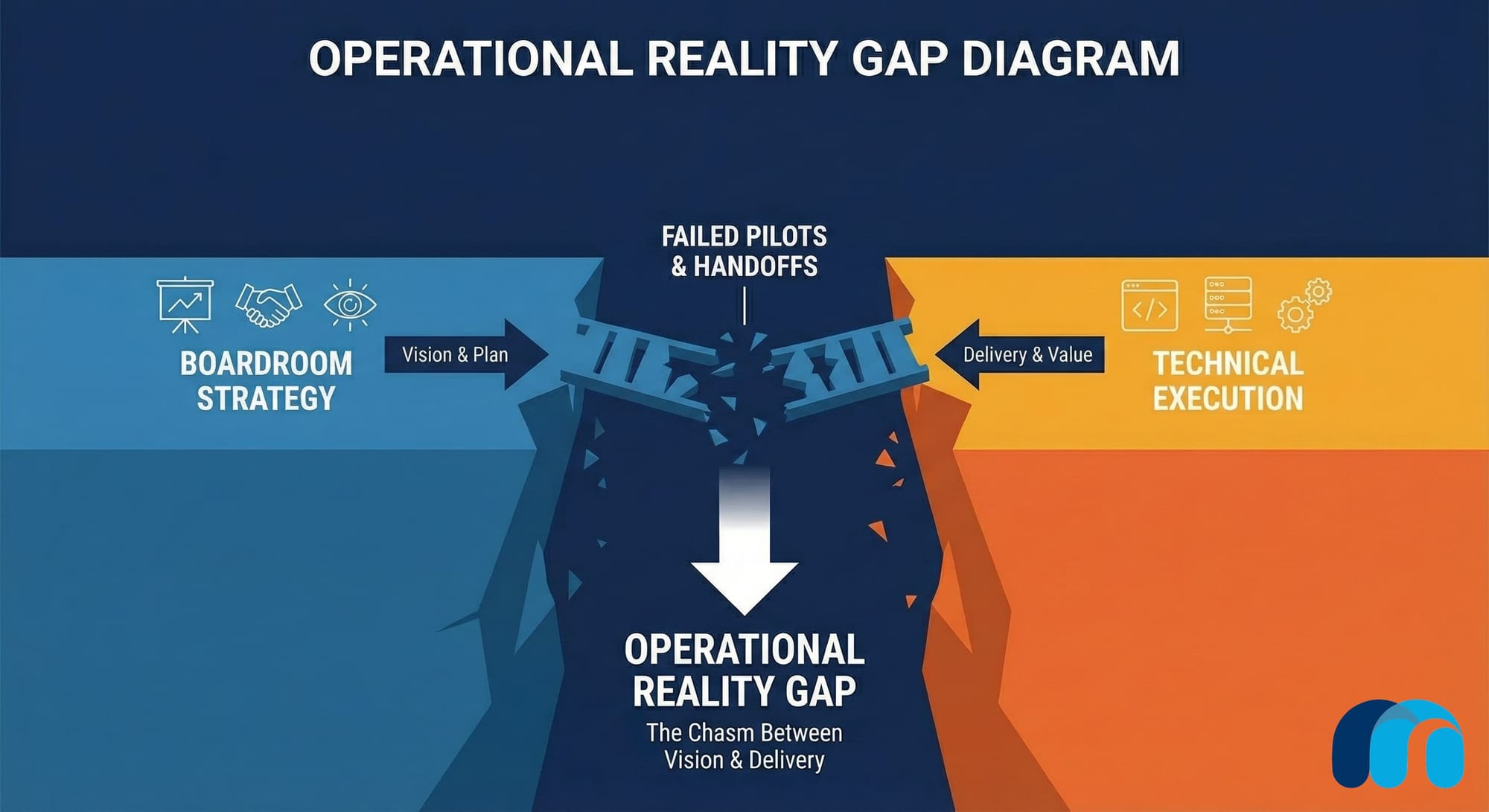

2026 demands a shift from AI pilots to Agentic Intelligence. Mid-market CDOs must bridge the "Operational Reality Gap" using Strategy-in-Motion™ PODs. The focus: industrialize data, weaponize compliance (1033/TEFCA), and deploy autonomous agents to drive immediate P&L value.

As fiscal year 2026 begins, the "GenAI Gold Rush" that defined the last three years has officially concluded. The era of unbridled experimentation, characterized by fragmented pilots and isolated chatbots, has left a hangover in its wake. We call this state "Pilot Purgatory," a condition where 74% of organizations have struggled to move AI initiatives beyond the lab and into the P&L.

For the Chief Data Officer (CDO) in mid-market Banking, Financial Services, and Insurance (BFSI) and Healthcare, the mandate has shifted. The job is no longer to "explore" intelligence; it is to industrialize it.

2026 marks the dawn of Agentic Intelligence, autonomous systems capable of reasoning, planning, and executing complex workflows. To survive the tightening regulatory web (Section 1033, TEFCA) and the pressure from hyper-scale competitors, mid-market CDOs must cross the "Operational Reality Gap." This creates a requirement to move from static data lakes to dynamic Data Foundries, and from siloed project delivery to integrated Strategy-in-Motion™.

Part I: The Macro-Shift to Agentic Economics

To understand the 2026 agenda, one must recognize the fundamental economic inversion of AI. Previously, capital expenditure was dominated by training models. Today, we are witnessing the "Inference Flip." By the end of 2026, nearly 80% of AI compute budgets will be dedicated to inference, the actual running of models to generate business value.

For the mid-market CDO, this implies two things:

- The Cost of Intelligence is Falling: Software optimizations are driving down the cost of reasoning.

- The Cost of Context is Rising: Your legacy "Data Swamps" filled with dark, unstructured governance nightmares are incompatible with the low-latency, high-accuracy demands of Agentic AI.

This economic reality forces a move away from "Empire Building" (hiring massive internal teams) toward Ecosystem Orchestration. The winning CDO of 2026 does not own every resource; they orchestrate a network of partners, platforms, and automated agents to deliver outcomes.

Part II: The Mesh Digital Operating System

Mid-market firms possess a structural advantage over the Fortune 50: Agility. They lack the decades of bureaucratic inertia. However, realizing this potential requires a new operating system that fuses strategy and execution.

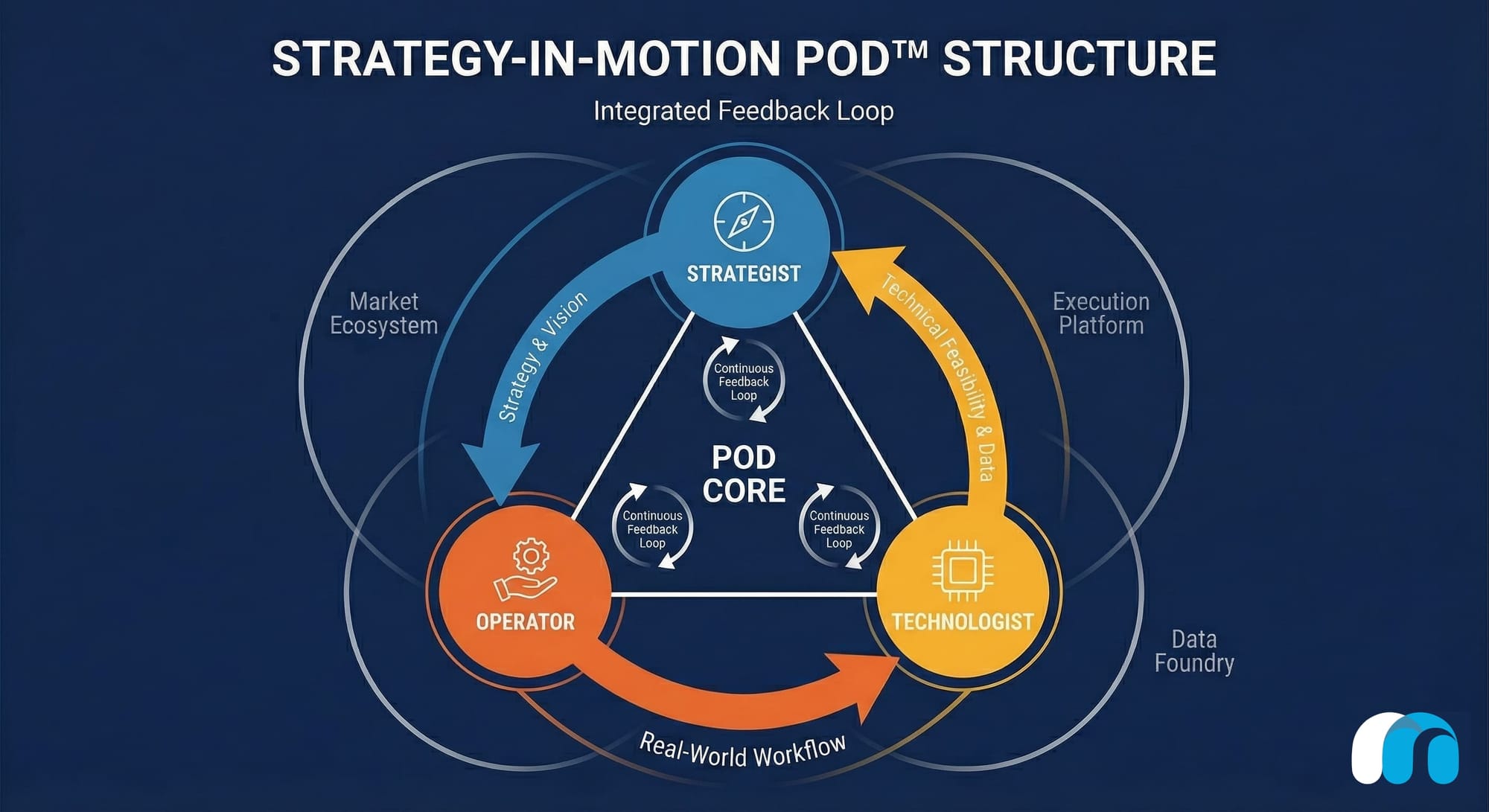

1. The Strategy-in-Motion POD™

The traditional consulting model, where strategy is "handed off" to delivery teams is the primary cause of failure. Mesh Digital advocates for Strategy-in-Motion PODs™. These are cross-functional, autonomous units composed of three fused archetypes:

- The Strategist: Ensures P&L alignment and "North Star" vision.

- The Operator: Subject matter experts (e.g., former Clinical Directors or Lending Heads) who know the "ground truth."

- The Technologist: Architects who ensure technical feasibility and scalability.

2. The Capital-Stack Mesh™

Data projects often fail because they speak "Python" when the CFO speaks "EBITDA." The Capital-Stack Mesh™ framework aligns data investments with the firm’s capital lifecycle. In 2026, CDOs must perform "Capital & Value Diagnostics" to identify exactly where data investments will yield the highest return before writing code, shifting from heavy upfront CapEx to flexible OpEx subscription models.

Part III: Sector Deep Dives – The "Killer Apps" of 2026

The shift to Agentic AI moves technology from being a "Co-pilot" (assisting a human) to a "Digital Worker" (performing the work). This distinction transforms the P&L in regulated industries.

BFSI: Weaponizing Section 1033

By April 2026, the Consumer Financial Protection Bureau's (CFPB) Section 1033 rule will be fully operational, codifying Open Banking. While many view this as a compliance burden, forward-thinking CDOs are using it as an offensive weapon.

- The Play: Build a high-performance Developer Interface to ingest data from other institutions.

- The Outcome: Create a "Financial Super-App" that aggregates a customer’s complete financial picture, allowing Agentic Advisors to offer hyper-personalized, outcome-based advice (e.g., "Move this balance to save $400 in interest").

Healthcare: TEFCA and Care Gap Closure

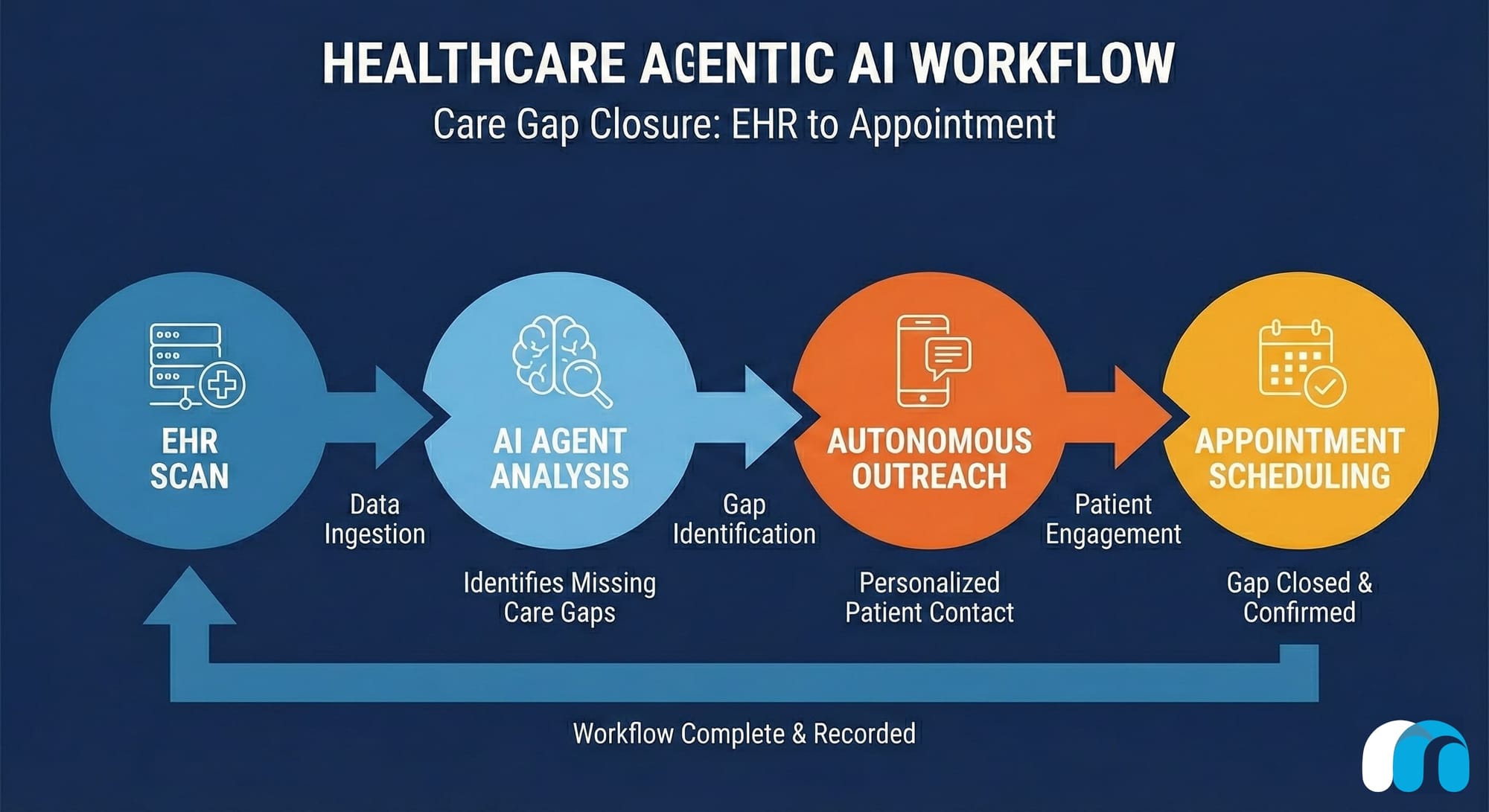

In Healthcare, TEFCA (Trusted Exchange Framework and Common Agreement) has turned interoperability into a defensive moat.

- The Play: Connect to a Qualified Health Information Network (QHIN) to build a longitudinal patient record.

- The Outcome: Care Gap Agents. Unlike passive chatbots, these agents scan EHRs, identify missing screenings (e.g., mammograms, endoscopies), and autonomously contact patients to schedule appointments. This directly closes gaps, securing Value-Based Care (VBC) reimbursements.

Part IV: The Top 10 Strategic Priorities for 2026

Synthesizing the macro-trends and sector imperatives, these are the non-negotiable priorities for the mid-market CDO.

1. Industrialize the Data Foundry

The Mandate: Transition from ad-hoc data lakes to a product-grade Data Foundry. Why: Agents need "grounded" data to prevent hallucinations. You must implement a semantic layer that encodes business logic (e.g., defining "Churn" or "Readmission") directly into the data fabric, supporting multimodal ingestion (text, images, audio).

2. Operationalize Agentic AI

The Mandate: Move from "Chat" to "Work." Why: Efficiency gains come from autonomy. Deploy agents with specific goals and "Action Spaces" (APIs they can control) to execute high-friction workflows like prior authorization or claims adjudication.

3. Master Regulatory Interoperability (1033 & TEFCA)

The Mandate: Weaponize compliance. Why: Interoperability is now a competitive product. Treat your API interfaces as strategic assets to attract partners (BFSI) or consolidate patient views (Healthcare).

4. Establish the Governance Control Plane

The Mandate: Shift from "Gatekeeper" to "Guardrail" governance. Why: You cannot manually approve every decision an autonomous agent makes. Implement a "Control Plane" that enforces Zero Trust policies on non-human identities and monitors for drift in real-time. CISO's should also take note, NO isn't the right answer here either.

5. Realign the Operating Model (Strategy-in-Motion™)

The Mandate: Eliminate the "handoff." Why: Speed to market is the primary differentiator. Reorganize delivery teams into PODs (Mesh's or yours) that own the outcome from Board Deck to Shipped Value.

6. Close the "Value Gap" (Outcomes-Based AI)

The Mandate: Focus relentlessly on P&L impact. Why: CFO scrutiny is at an all-time high. Deploy specific "Killer Apps" (like Claims Severity Agents) and measure success in dollars preserved or revenue generated, not technical metrics.

7. Secure the Edge & Identity (Sovereign AI)

The Mandate: Protect the "Crown Jewels." Why: Reliance on public API models poses sovereignty risks. Adopt a strategy where sensitive models are hosted in private environments, ensuring data privacy and continuity.

8. Cultivate the Change Champion Network

The Mandate: Win the "Hearts and Minds." Why: Cultural resistance is the #1 killer of Agentic AI. Identify mid-level influencers to "co-create" the agents, turning them from detractors into advocates.

9. Orchestrate the Ecosystem

The Mandate: Manage the network, not just the stack. Why: No firm can build everything. Build a composable architecture to plug in best-of-breed partners (consultants, fintechs, healthtechs) seamlessly.

10. Optimize Capital Allocation

The Mandate: Speak the language of the CFO. Why: Funding is finite. Use the Capital-Stack Mesh™ to frame data initiatives as capital assets, aligning costs with value realization.

Conclusion: The Age of the Orchestrator

The transition into 2026 marks the end of "Digital Transformation" theater. The slide decks have been presented. The hype cycle has crested. What remains is the hard, essential work of operations.

Success in this era will not be defined by who owns the most data, but by who orchestrates it most effectively to solve human problems. By embracing the Mesh Digital operating system, deploying our Strategy-in-Motion PODs™, building an industrialized Data Foundry, and managing the Capital-Stack, the mid-market CDO can bridge the Operational Reality Gap.

The mandate is clear: Stop piloting. Start building. Start orchestrating.

Next Step for CDOs

Would you like to run a Rapid Capital & Value Diagnostic to assess your organization's readiness for the 2026 Agentic Agenda? This 2-3 week assessment identifies your highest-impact "Killer App" use cases and aligns them with your CFO's capital constraints.